“Heart-Healthy Lifestyle in Every Decade”

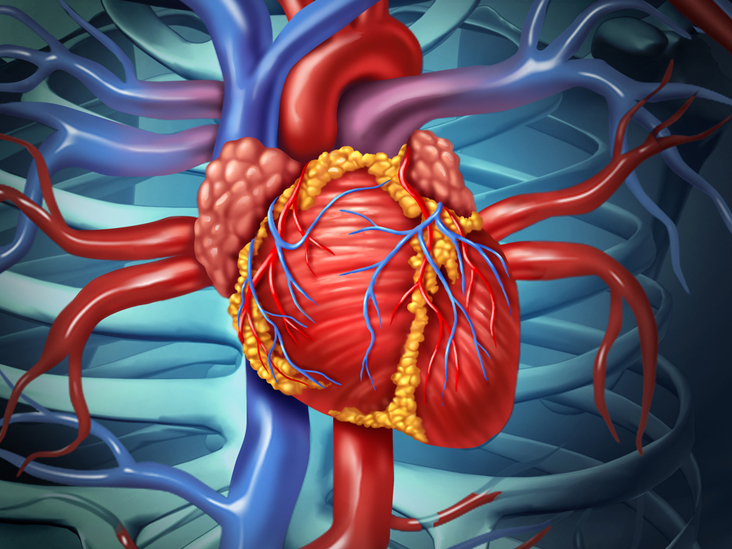

The heart is a part of the body inside your chest that pumps blood around your body and keep you alive. Many people nowadays are suffering from heart disease, and many of them died. The death rate from heart attack seems increasing up to now. It is very important to be aware of how to take good care of our hearts. We’ve always worked out but only because we wanted to look good, not because we thought we were doing something good for our hearts. It’s never too early for you to adopt a heart-healthy lifestyle.

If you are between 20 and 30 years old, the preventive steps you take now will have far-reaching consequences on your heart health throughout your life.

Your lifestyle is made up of everyday choices— what you eat, and how physically active you are, whether you smoke, drink alcohol, or use birth control pills, all of which may have a major impact on your long-term health.

Make a heart-smart choice today and every day.

a.) Establish healthy eating patterns and identify healthy foods and beverage options for your grab-and-go lifestyle.

b.) Remember that your body is keeping score. Stay away from junk food and calorie-laden beverages just to control on how to look good on the outside. A steady diet of unhealthy fats and sodium will gradually damage your arteries.

C.) Learn about your family’s health history to determine whether you’re at risk for heart disease.

At the 20’s:

By your 20’s is a good time to start thinking about what’s going on with your heart and cardiovascular system. It’s not just a man’s disease or an old person’s disease. Heart disease is largely preventable. Important research has identified that lifestyle choices such as poor diet, lack of physical activity smoking, and drinking excessive amounts of alcohol are controllable risk factors for heart disease.

Your heart-healthy priorities for your 20’s are :

1. Pay attention to what you eat.

2. Adopt a regular exercise routine.

3. Manage your weight.

4. Check your family history for risk factors.

5. Schedule regular annual check-ups.

6. Don’t smoke

7. Be aware of social situations affect your life

8. Choose your birth control method carefully.

At the ’30s

Most women in their 30’s are busy. Really busy, but don’t be too busy to take care of yourself.

To make your heart health priority:

a.) Start managing your weight now.

b.) Make sure exercise is on your to-do list or daily planner.

C.) Monitor your numbers.

By your 30’s there’s a good chance that you have already developed some potential threats to your heart. You might even be able to reverse the effects of poor choices you may have made in your 20’s. You can start small. Focus on the important things you can control, such as eating well and exercise.

Your heart-health priorities for your 30’s are:

1. Commit to taking care of your health now.

2. Develop a nutritious eating plan.

3. Add physical activities to your schedule.

4. Establish a healthy weight and maintain it.

5. Record your family’s health history.

At the ’40s

Statistics show that being a woman if you reach your 50’s without developing the major risk factors for heart disease, you face only an 8 per cent risk of developing cardiovascular disease. With those odds, it just makes good sense to work or continue to work at staying at risk-free as possible. Your 40’s present a golden opportunity to take charge and improve your health or recommit to the healthy-lifestyle you may already be living. That most actionable steps you can take with the biggest pay off are eating well, being physically active, and managing your weight. Resolve to make every calorie count toward good nutrition and every step count toward an active way of life.

Your heart-healthy priorities for your 40’s are:

1. Stick to a healthy eating pattern.

2. Stay active.

3. Maintain a healthy weight.

4. Know your risks.

5. Develop a good relationship with your doctor.

Even if you’ve lapsed into a sedentary lifestyle over the years or have never been active at all, it’s not too late to make exercise part of your prescription for being and staying healthy.

C.) Make sure your heart-healthy is part of every physical exam.

1. Establish a nutritious eating plan.

2. Be physically active.

3. Maintain a healthy weight.

4. Monitor existing risk factors.

5. Manage the risk factors that you can control or change.

6. Recruit a team of health care providers.

7. Take your medications to control risk factors

8. Educate yourself about any heart condition you may have. You need to balance your daily food intake with the energy your body is burning. Hormonal changes resulting from menopause can affect your cholesterol and triglycerides levels.

. Trying not to scream at the top of my lungs for feeling being unlucky of having such curly hairs, I then washed my face, brushed my teeth, and without any hesitation, still trying to make some selfie before starting up my day.

. Trying not to scream at the top of my lungs for feeling being unlucky of having such curly hairs, I then washed my face, brushed my teeth, and without any hesitation, still trying to make some selfie before starting up my day.