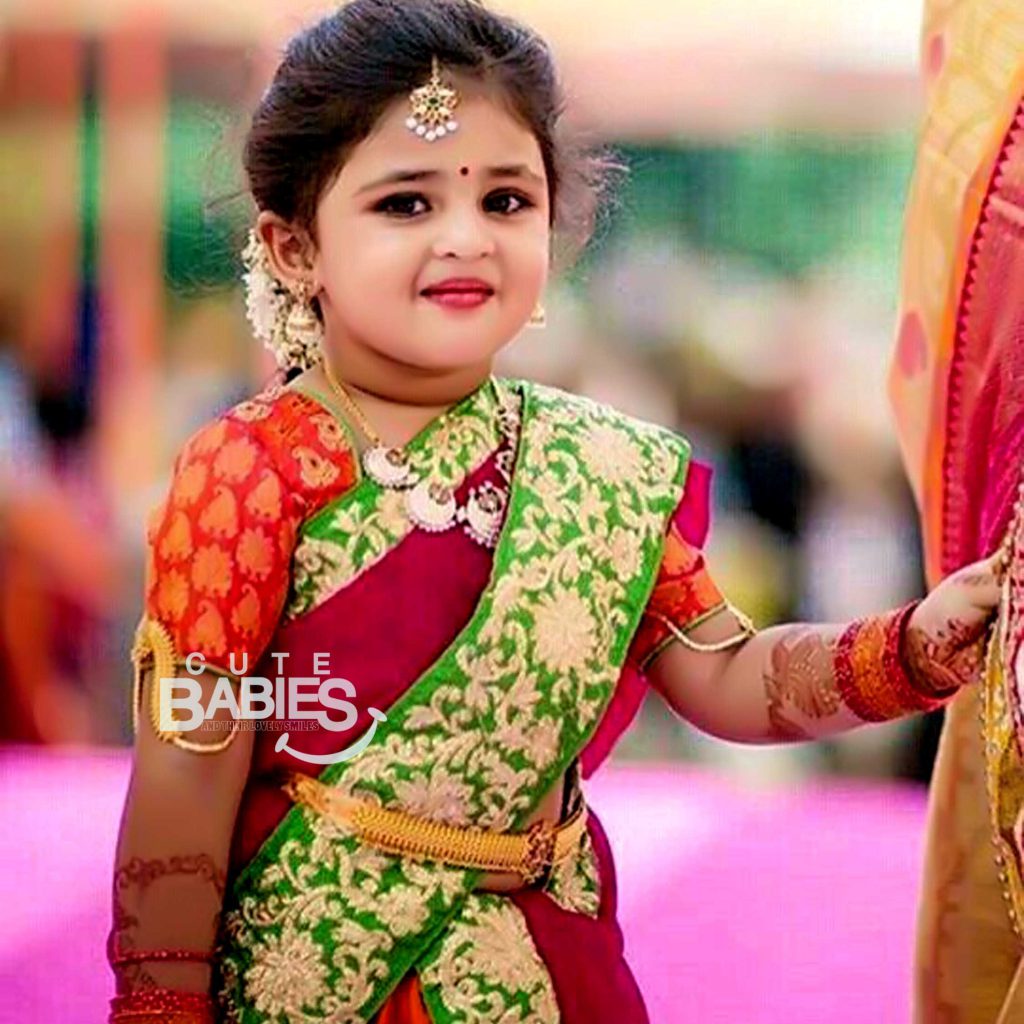

Some Cute Indian Baby Girls 15 Images

How is life insurance premium determined?

The top-notch that you need to pay for a life insurance arrangement relies upon different components like age, absolute inclusion (entirety guaranteed), your clinical history, sexual orientation, lifestyle, and employment.

In any case, the premium for a similar life insurance inclusion sum will change from back up plan to safety net provider.

How can it be that the premium cited fluctuates? How is the premium on a life insurance strategy determined? Peruse on to discover.

What is life insurance and why you pay a premium?

A life insurance approach is an agreement between a backup plan and a policyholder. To make the agreement legitimate, a top-notch sum is paid by the policyholder at the hour of purchasing the approach and later at concurred interims of time, contingent upon the recurrence and method of instalment.

Life insurance is an approach to give your family (the chosen people) budgetary help in the event of the guaranteed’s inconvenient death. By and large, on account of death the policyholder during the approach term, a pre-concurred sum (total guaranteed) is paid to the candidate.

Remembering the above view, you should comprehend the accompanying three significant elements that are key determinants in the life insurance premium computation for each backup plan. The top-notch sum contrasts among back up plans because of these components when you look at their arrangements for a similar inclusion/whole guaranteed.

1. Mortality and guaranteeing process

The way toward endorsing decides your life insurance premium. In the endorsing procedure, different elements are thought about like your age, sexual orientation, occupation (regardless of whether you are related with an unsafe calling), lifestyle, strategy residency, any inherited infections in the family, etc.

Rakesh Goyal, Chief, Probus Insurance said that each backup plan has an alternate endorsing process and evaluate hazards in an unexpected way. He clarified, “In light of the evaluation, every safety net provider may arrange the hazard contrastingly for a similar profile, as indicated by which they choose the lower or higher premium for their life insurance plan.

” Separated from this, the life insurance premium is additionally determined on an actuarial premise (a scientific and factual strategy to survey hazard in insurance) that considers the likelihood of death happening at specific age levels.

Santosh Agarwal, Boss Business Official Life Insurance, Policybazaar.com said that there is no technique or standard recipe to compute premium in that capacity, in any case, the guarantor decides the danger of death related with the individual in the endorsing procedure and charges the premium in like manner. “It is expected/evaluated based on the way that for a 50-year-old individual the exceptional will be normally higher when contrasted with an individual of a more youthful age as extensively the insurance premium is resolved based on their likelihood of becoming sick, any current infections, and so forth.,” she included.

2. Costs and net revenues

The exceptional sum fluctuates over a few safety net providers in light of the fact that the premium does not just rely upon the elements identified with the policyholder yet additionally on factors identified with the backup plan, that is, the costs caused by the guarantor recorded as a hard copy the strategy. “For life insurance designs the premiums may contrast since back up plans will have distinctive cost structures, appraisal of hazard and speculation returns. Thus, in spite of the fact that the components used to decide premium are the equivalent the results will be unique,” says Kapil Mehta, Chief, SecureNow.

You may by and large not notice the costs factor in your exceptional sum. In any case, you should realize that the operating expense is additionally added to the arrangement premium.

The operational expenses may incorporate office costs, for example, the expense of the arrangement archive, the insurance specialist’s bonus, and other overhead costs of the safety net provider.

Agarwal stated, “When the safety net provider shows up at the hazard cost examination factors identified with the policyholder, the guarantor adds costs to the insurance premium. By and large, insurance organizations include operational expense alongside the normal net revenue to show up at the last premium sum.

” The benefit an insurance organization can make from an insurance approach assumes a significant job in choosing the last insurance premium of your life spread plans. This is the reason premiums for a similar measure of inclusion from guarantor to back up plan changes.

3. Exigency component

Various variables are included while figuring the life insurance premium. One of the minor supporters of the premium is possibility charges. For example, the number of guarantee settlements can’t be evaluated, that is, what the number of cases a backup plan will get during the year is really not known.

Goyal said that in spite of the fact that possibility commitment to premiums isn’t a lot for policyholders independently to shoulder, it plays a noteworthy job for an insurance organization. If there should arise an occurrence of unexpected or unavoidable circumstances or an unforeseen enormous number of cases in a year, the consideration of possible factor in the excellent spread over a huge pool of clients encourages organizations to keep up their funds. He stated, “A portion of these unusual examples incorporates passing case settlement proportion, regular or man-made dangers, changes in the guideline, new revisions, the disappointment of a recently propelled item true to form, etc. Therefore, it can, at last, but the insurance organizations’ venture in question.

” Consequently, along with these lines possibility, part of premium charged additionally increases the value of the money related and venture dependability of the organization and simultaneously includes the insignificant worth change in the premiums.

Would it be advisable for you to decide on a life insurance arrangement based on a lower premium?

In a perfect world, the case settlement proportion ought to be a decent beginning stage for short-posting insurance plans. This is on the grounds that a higher proportion gives you the confirmation that at the hour of cases, it would have a more prominent possibility of being endorsed.

Mehta says, “For term insurance, pick guarantors that have over a 95 per cent guarantee settlement proportion and the most reduced premium. For other life insurances, take a gander at these three factors: a generally higher inferred speculation return anticipated in the delineations, a high passing advantage gave and moderately lower give up charges.”